When I was applying to college, I was fortunate enough to have plenty of options. I couldn't wait to see what financial aid I would be able to get as that would decide where I went. Once the packages started rolling in, I saw that even though my family's income was low, all I qualified for was lots of student loans as my parents were frugal savers.

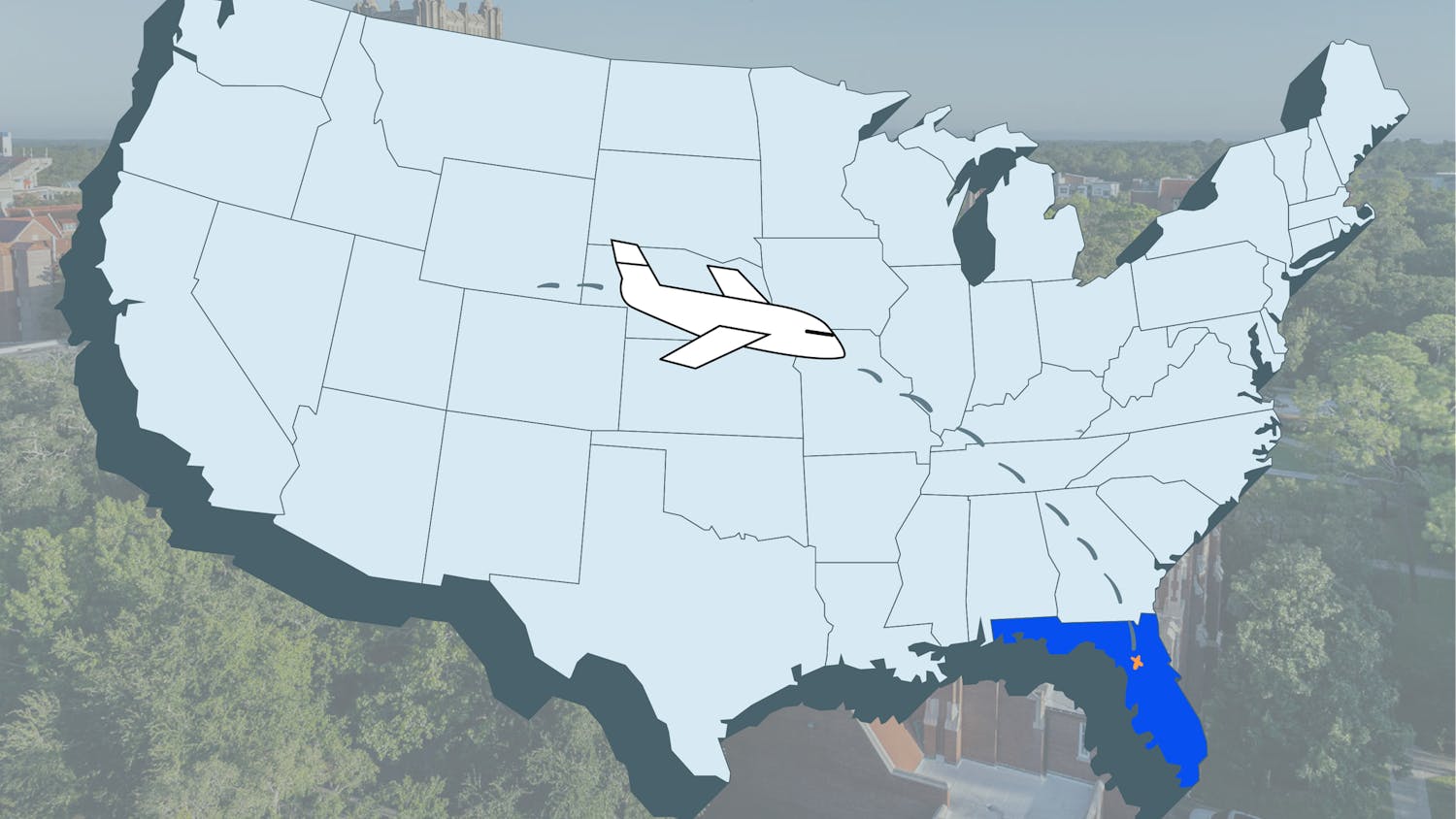

I made a financial decision to attend UF. I didn't look at the quality of undergrad programs at other schools because it was a moot point since I couldn't afford them without taking out tens-of-thousands of dollars in student loans. Financial decisions like these happen every year, and the new changes proposed by the Obama administration make it easier and cheaper to get large student loans, making it easier than ever to mortgage your future. We should make student loans more difficult to obtain, not easier.

Some in the higher education community feel that everyone must have the opportunity to attend college. Despite having a massive conflict of interest, universities tell us that the only way we can be successful in life is to have the right degrees from the right brand-name schools.

This attitude leads countless students picking up extra master's degrees because they just don't have any idea what to do next. I would argue that one year of your life and $50,000 in the red is an expensive way to find yourself.

The alterations in the government's student loan program build on the changes enacted earlier in 2010 when the feds took away the right of banks to make student loans. Payments on some loans will be limited to 10 percent of discretionary income, and any outstanding balance after 20 years of payments will be forgiven. Some members of Congress are trying to cut the interest rate for these loans.

At 6.8 percent next year, this debt is far lower than what one would pay on credit cards, but also higher than what a family with good credit would have to pay on the private market, which is slowly dwindling due to government-run loans.

These efforts sound eerily familiar to what the government said about the right to own a home. Credit was made cheap with countless government programs and guarantees, and regulators encouraged banks to make risky subprime loans to extend credit to noncredit-worthy individuals.

Government involvement in the student loan business is a dangerous development, especially as total student-loan debt is approaching $1 trillion.

Federal programs do not provide strong incentives for poorer people to take advantage of the abundant opportunities for affordable higher education. UF is the best university in the state and should remain the destination of choice for students from modest means. Anthropology and sociology degrees are reasonable to study at a place like UF where you will be in debt up to $20,000 after graduation. ROTC should be encouraged as a route for students who want to attend more expensive colleges. Also, two-year community colleges are significantly cheaper and offer a great way for cash-strapped students to get a four-year college education.

As a society, we must support the idea that success does not require any college degree; it's the fire inside to be successful. I have no problem with students taking out debt, but why should we not require money down like with houses? We need students to realize how much money they are throwing away by attending a private, liberal arts college over a university.

Furthermore, the government is making huge profits on charging students 6.8 percent on loans that cannot be discharged in bankruptcy court while the government borrows that money at sub-3 percent rates. Government should not have rights like a business because its power is not limited. Relying on the private student loan market to fund higher education makes the student realize the full cost of his or her decision to not go to a public institution.

Travis Hornsby is a statistics and economics senior at UF. His column appears on Mondays.