The Paycheck Protection Program under the CARES Act provides loans to cover payroll costs, interest on mortgages and rent and utilities of businesses that have been affected by COVID-19, according to the U.S. Small Business Administration.

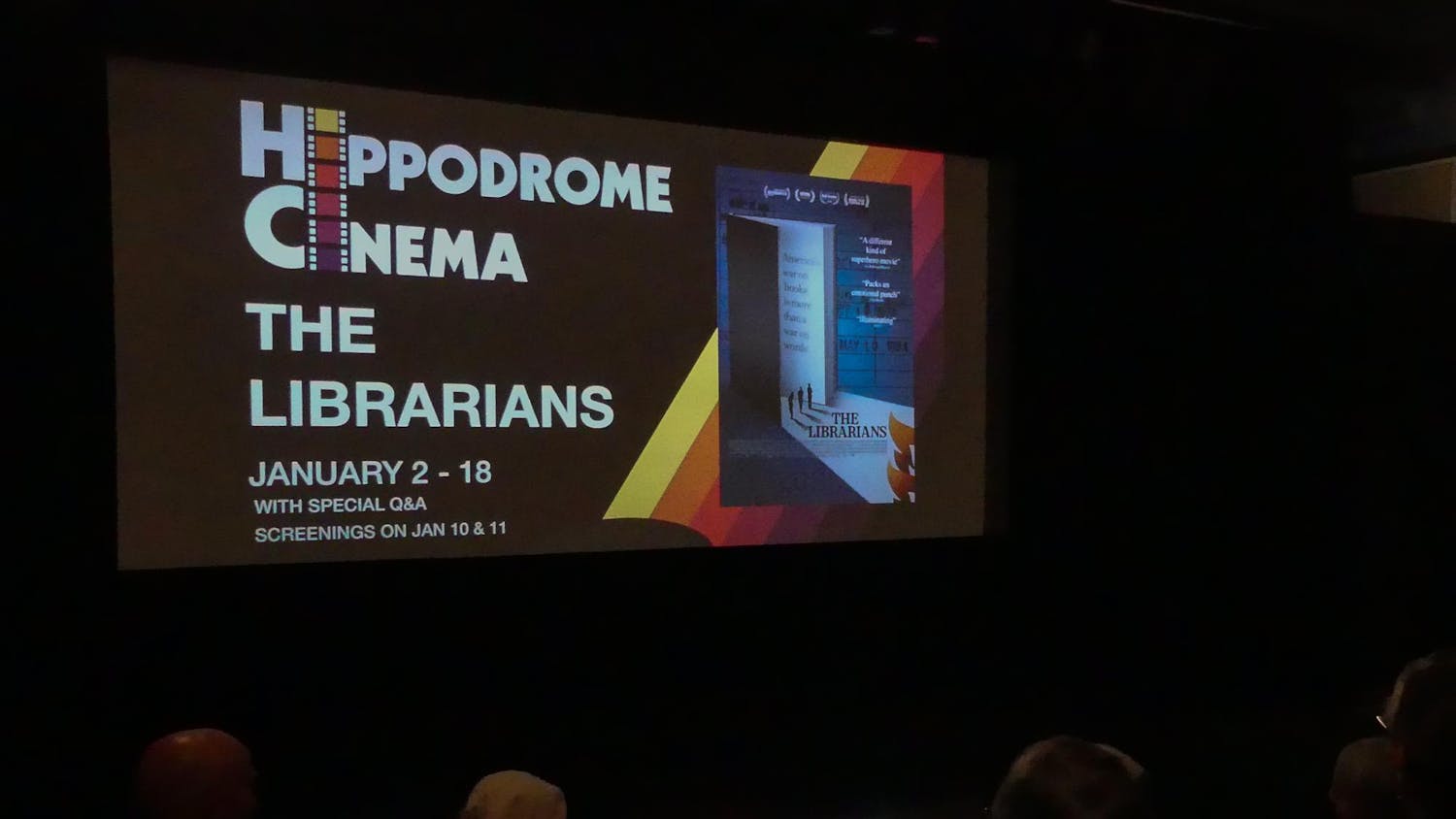

Nicole Daenzer laid off all employees at The Hippodrome Theatre during a Friday staff Zoom meeting early April. Half an hour later, she got an email from the bank saying the theater’s $200,100 Paycheck Protection Program loan had been approved.

She immediately rehired her staff.

“If we hadn't gotten this money, we would have had to close a while ago,” Daenzer, the Hippodrome’s managing director, said.

Daenzer said that when the pandemic began, the Hippodrome stopped putting on shows and providing arts classes. She said employees started to work from home, and she assigned maintenance tasks like fixing the sound and light systems. Although the building wasn't open, they continued working, she said.

The Paycheck Protection Program under the CARES Act provides loans to cover payroll costs, interest on mortgages and rent and utilities of businesses that have been affected by COVID-19, according to the U.S. Small Business Administration.

Businesses with 500 or fewer employees can apply for loans. Sole proprietorships, which are businesses owned and run by one person, independent contractors and self-employed individuals can apply as well, according to the SBA. They can do so through any SBA lender, an approved financial institution that gives loans subsidized by the federal government to small businesses.

The deadline to apply for PPP was originally June 30, but because more than $130 billion out of the $649 billion remained, President Donald Trump signed a bill on July 4 extending the deadline through Aug. 8.

The SBA said the loan can be fully forgiven, or the recipient will not have to pay the loan back, if businesses spend at least 60 percent of it on maintaining and rehiring employees. Businesses will not be penalized if employees are offered their jobs back with the same hours and wages, and the employees choose not to return.

Changes made to the PPP on June 5 also allow new applicants to have up to 24 weeks to spend their PPP loan, instead of two and a half months as when it was first put in place.

“The PPP gave us three extra months to be able to sit down and try to figure out other ways to sell tickets to put on shows,” Daenzer said.

Daenzer said the PPP allowed them to keep and pay 45 employees, and that they have made sure to spend every penny correctly so their loan can be fully forgiven. However, they are now again running out of money, she added.

“We're going to have to really figure out how to make money in different ways because we might not be able to put on a play until maybe December,” Daenzer said. “Right now we're doing a virtual play, which is really fun. It's very exciting. But it's not the same thing as being on stage.”

Satchel Raye, owner of Satchel’s Pizza, a restaurant with about 45 employees, heard about the PPP by following the news and was able to apply with the help of his accountant in early April.

When the pandemic hit, Raye said he had to lay off 26 employees within the first week, and his business’ revenues dropped by over 60 percent. Raye said he started looking for ways to adjust and keep his customers engaged.

“I’m always of the idea that you have to go with the flow,” Raye said. “In this business, change is inevitable. Change comes all the time in all different forms, so you have to be quick, and you have to adjust.”

The restaurant stayed open for six weeks with take-out orders only. Raye said he adopted safety measures to enhance their customers' experience such as leaving doors open to minimize contact with surfaces and putting tape lines on the floors so people could keep distance from one another. He also put plexiglass in front of the cashier and the host station to prevent the spread of the virus, Raye said.

Raye said that the restaurant has always been centered on customer experience in the form of live music, large crowds and the chance to eat in a van, under a plane or in a greenhouse. To keep their customers engaged, they decided to start doing Facebook live videos and selling items such as puzzles, cards and hygiene products so that people could buy them as they were picking up their food.

With the PPP loan, Raye could rehire 20 out of the 26 employees he had laid off, he said. The restaurant is now open at 60 percent capacity.

“By hiring a bunch of people back, we were able to have the business run smoother, and when the business runs smoother, then more people can come because when they come they have a good experience, and they want to come back or they tell their friends,” Raye said.

Raye preferred not to share how much loan he asked for, but according to SBA data, his loan falls within the $150,000 to $350,00 loan range.

Raye is now out of money and is not sure whether his loan will be fully forgiven, but he said that no matter how much he would have to pay back, it will not exceed the initial loan amount.

The interest rate of PPP loans is 1 percent, and businesses don’t have to pay during the six months following the date of disbursement. Before June 5, loans had to be paid in two years. Now, loans can be paid in a 5-year span, according to the SBA.

In Gainesville, 379 businesses have applied and been approved for PPP loans of $150,000 or more since April, according to a list released by the federal government on July 6.

“I think it [PPP] benefits a lot of people. I think a lot of people were scared to get it and it could have benefited them. I think that some people got it that shouldn't have got it that didn't probably need it,” Raye said.

Aurora Martínez is a journalism senior and the digital managing editor for The Alligator. When life gives her a break, she loves doing jigsaw puzzles, reading Modern Love stories and spending quality time with friends.